Investing in resort real estate is actually a current trend. Investors often seize the opportunities available in the real estate market, thereby investing and making very high profits. However, not everyone knows how to “make money” from their initial capital. This article will help you solve that problem.

Why invest in resort real estate?

Stability

The target audience of resort real estate projects are mostly people with high income, idle capital and not in a hurry. Resort products are often quite expensive and only promote liquidity at an average time of about 5 years, when the project has begun to be recognized as a brand and operates stably.

Therefore, to make immediate profits, the project location and services must be truly attractive enough to attract target customers. Although the "capital incubation" period is quite long, in return, the profit from investing in resort real estate once it is in motion is always stable over a long period of time.

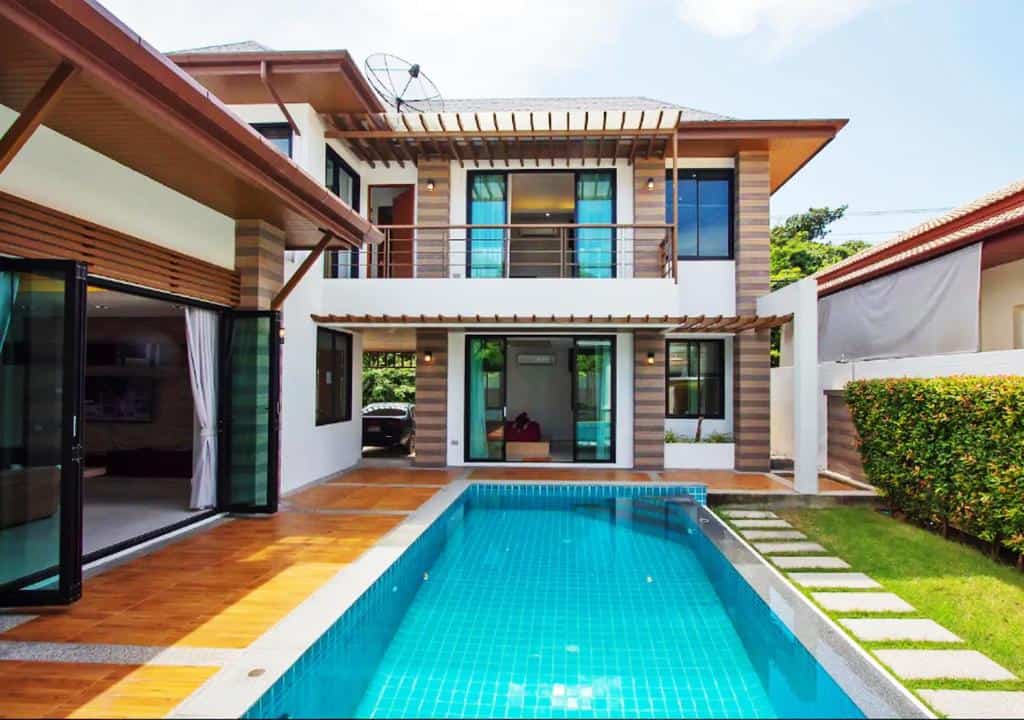

Resort real estate is not just an investment, it is also a second home.

Above all, customers who invest in buying villas or resort apartments are a group of customers who have large savings, and their outstanding desire is not only money. Besides interest rates, owning a resort villa for yourself is one of the most wonderful things.

What risks should you consider when investing in resort real estate?

Everything has two sides, and although it is an attractive business, promising long-term profits, investing in resort real estate also has potential risks that investors need to consider:

Risk of phase deviation due to rapid development

According to statistics from HoREA, from 2014 to now, there has been a fever of condotel investment and development nationwide, concentrated in coastal areas: Van Don, Ha Long, Da Nang, Nha Trang, Mui Ne, Phu Quoc, Lam Dong, Dong Nai... According to statistics up to September 2017, there were 77 large-scale tourist and resort projects alone, with a total area of 18,019 hectares.

In addition, there are hundreds of small and medium-sized resort tourism projects, with an estimated total area of about 50 hectares/area. According to HoREA, there is an imbalance between condotel apartments and hotel rooms. Specifically, condotel apartments account for 56%, while hotel rooms account for 44%. This is an unusual ratio compared to other countries in the region, where hotel rooms are usually more expensive than condotels.

Risks from the regional and world economic situation

The global recession of 2009 had a strong impact on all major economies in the world. Although Vietnam was less affected by this crisis, its impact on the Vietnamese economy is undeniable. The number of international tourists decreased, the amount of remittances also decreased, causing the Vietnamese tourism and real estate markets to stagnate and not flourish.

Meanwhile, these are the two major markets that determine the revenue from renting out beach villas, and the value of the beach villas. According to experts, Vietnam only opening up to integration in part, while the rest is still regulated by the state, will be able to help Vietnam avoid major recessions.

And in the next 20 years, Vietnam will not be able to fully integrate, and the economy still needs self-regulation from the state. This is a fairly safe signal for those who want to invest in the Vietnamese real estate market.

Stay tuned for AHS's next articles for a clearer view of investing in resort real estate.