Surely you have heard of resort villas. That's right, this type of investment is making investors "boil", but not everyone understands this type clearly. So let's learn more with AHS through this article.

What is a resort villa?

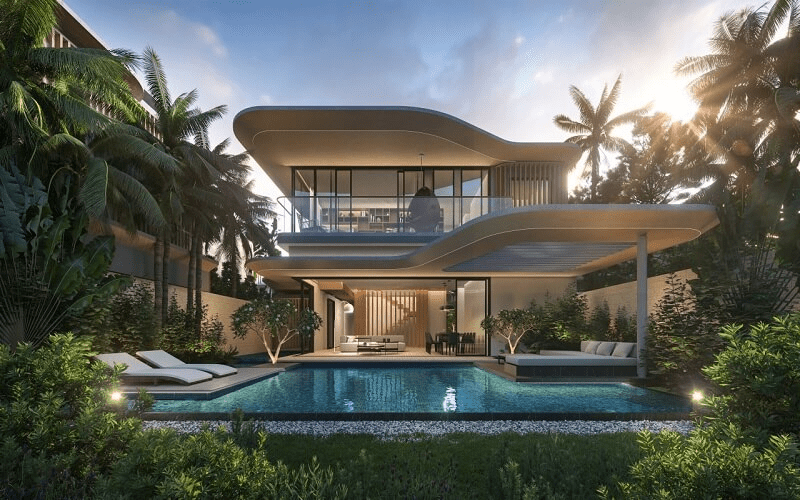

Resort villas can be understood most simply as a type of architecture designed in the form of a villa, serving the purpose of rest and relaxation during trips and vacations. Accordingly, villas are always real estate with sophisticated, unique, luxurious, spacious and comfortable architecture.

Because of the purpose of resort, these villas are built in places with developed tourism and services, places with beautiful natural landscapes such as coastal areas, mountainside areas, suburbs, on farms, golf courses, etc.

Opportunities when investing in resort villas

Great market potential, safe investment

Vietnam is a country with great tourism potential, from its geographical location to its landscape advantages. Domestic and foreign tourists are increasingly changing their mindset in choosing accommodation for their vacations, emphasizing modernity, uniqueness and convenience.

Objectively, Vietnam’s resort real estate still has many opportunities to make a breakthrough. Most of the investors of resort villa projects are large, reputable and experienced enterprises. Only then will they have enough economic potential as well as bring high commitment for customers to choose.

In addition, most resort projects are large-scale projects, carefully prepared from planning to design. When starting to implement, the investor has calculated to bring maximum potential to the project.

In particular, they pay great attention to the legal aspect - a decisive factor for progress and reputation in the market. Resort villas are often built in resort and hotel projects with facilities such as restaurants, shopping centers, entertainment, spas, golf courses, etc. Therefore, the operating capacity of resort villas is always high at over 80%.

Affirming the owner's class

In the world, hillside villas and mountain villas are always two valuable types, helping to affirm the owner's class.

Investment form is not too difficult

Usually, when investing in large-scale real estate, investors will be quite hesitant about the management and operation stage. However, with resort villas, most of them already have a team in the project. Investors do not need to do too much, but the profits and income are still guaranteed regularly. Along with the projects are villa maintenance and repair services, which helps to prevent the quality of the product from being damaged or degraded.

Enjoy the policies at the project

Resort projects, in addition to bringing attractive annual returns, investors also enjoy preferential policies from the investor, such as 15 nights of annual stay at hotels or resort villas in the same system, the opportunity to experience many different projects, etc.

Risks from investing in resort real estate

Investing in resort real estate – sounds extremely attractive but has many potential risks and can even result in total loss. The first risk to mention is the risk of choosing an investment area.

Risks from choosing investment areas

A resort real estate product usually has a payback period of at least 10 years. 10 years is not a very long period of time but it is enough to completely change the relationship between two neighboring countries, completely change the economic and tourism development position of any territory; turn a country or an administrative region from having great tourism potential to a place with high investment risk.

Therefore, if you do not carefully consider: economic and tourism development policies, foreign policies, or even thoroughly research the leaders of the country or administrative region in which you intend to invest, you may still be at risk of not being able to recover your capital or losing everything.

Vietnam must be considered a very potential market for resort tourism activities. Maintaining a single-party government has helped Vietnam maintain long-term internal peace and stability for nearly 50 years (since the country was completely liberated).

Furthermore, after the “East Sea Oil Rig” incident two years ago, we have seen the ingenuity of the authorities, which can help Vietnam avoid long-term conflicts.

Liquidity risk

In fact, the investment in resort villas has lower liquidity than other investment types such as townhouses, apartments, and land. It is more suitable for long-term investment, "the goose that lays the golden eggs", rather than for short-term investment. Therefore, investors need to clearly define their investment goals from the beginning.